Author

Muni Kumar Meravath is a seasoned Healthcare Market Research Analyst with over 6 years of experience in the healthc.....

Immunological Rare Disease Market: By Drug Class, Fusion Proteins, Immunosuppressants, and Others), By Disease Indication, By Distribution Channel and Region Forecast 2021-2032

Immunological Rare Disease Market size was valued at US$ 3.6 billion in 2025 and is expected to reach US$ 11.2 billion by 2032, growing at a significant CAGR of 17.4% from 2026-2032. The immune system is delegated to defend the body from attacks from outside or inside. Many diseases can affect the immune system reducing its ability to defend itself or inducing an abnormal response against external or internal antigens. Immunological Rare diseases, often known as orphan diseases, afflict a small percentage of the population at any given time. Orphan medications are those that are suggested for the treatment of rare disorders. An orphan immunological disease affects less than 200,000 persons in the United States, according to the Food and Drug Administration (FDA).

Furthermore, Several diseases can affect the immune system. Disorders associated with a reduced response against no self-antigens are called immunodeficiencies. On the other hand, primary immunodeficiencies (PIDs) are in most cases rare diseases associated with specific, genetic mutations. Immunology medications or substances modify immune responses by enhancing or inhibiting the immune system. They are used to fight infections as well as to prevent or cure autoimmune or immunological illnesses such as rheumatoid arthritis, psoriatic arthritis, type 1 diabetes, and others. Rising awareness about rare immunological diseases such as Hypoalbuminemia and Hypovolemia, and Severe Congenital Protein C Deficiency in both developing and developed nations and the rising occurrence of immunological disorders due to environmental factors are critical reasons for increasing the demand for rear immunological drugs in the market.

Study Period

2026-2032Base Year

2025CAGR

17.36%Largest Market

North-AmericaFastest Growing Market

Asia-Pacific

A variety of variables, including hazardous chemical exposure, stress, dietary components, gut dysbiosis, and infections, all contribute to an increase in the number of persons suffering from rear immunological disorders. Immunological rare disease problems are now the most common cause of chronic illness in the United States, with a considerable number of individuals suffering from at least one form of rear immunological disease.

For instance, according to a study published by the National Stem Cell Foundation, roughly 4% of the world's population is afflicted with at least one of 80 or more with Immunological rear diseases. The rising demand for these treatments among the patient population is pushing industry participants' aggressive attempts to develop and introduce new pharmaceuticals into the market. As a result, the pipeline portfolio of leading immunology companies is expanding dramatically. For instance, there are around 30 pipeline projects of Sanofi in the immunology segment and around 20 pipeline candidates of Johnson & Johnson Services.

|

Report Benchmarks |

Details |

|

Report Study Period |

2026-2032 |

|

Market CAGR |

17.36% |

|

By Drug Class |

|

|

By Disease Indication |

|

|

By Distribution Channel |

|

|

By Region |

|

Download Free Sample Report

The immunological rare disease market size was valued at US$ 3.1 billion in 2024 and is expected to reach US$ 9.6 billion by 2031, growing at a significant CAGR of 17.36% from 2025-2031.

The market key players are: AbbVie, Inc. (U.S.) Janssen Global Services, LLC (U.S.) Eli Lilly and Company (U.S.) Novartis AG (Switzerland) Pfizer Inc. (U.S.) Bristol-Myers Squibb Company (U.S.) Merck Sharp & Dohme Corp. (U.S.) F. Hoffmann-La Roche Ltd. (Switzerland) Amgen Inc. (U.S.) Astellas Pharma Inc. (Japan) UCB SA (Belgium)

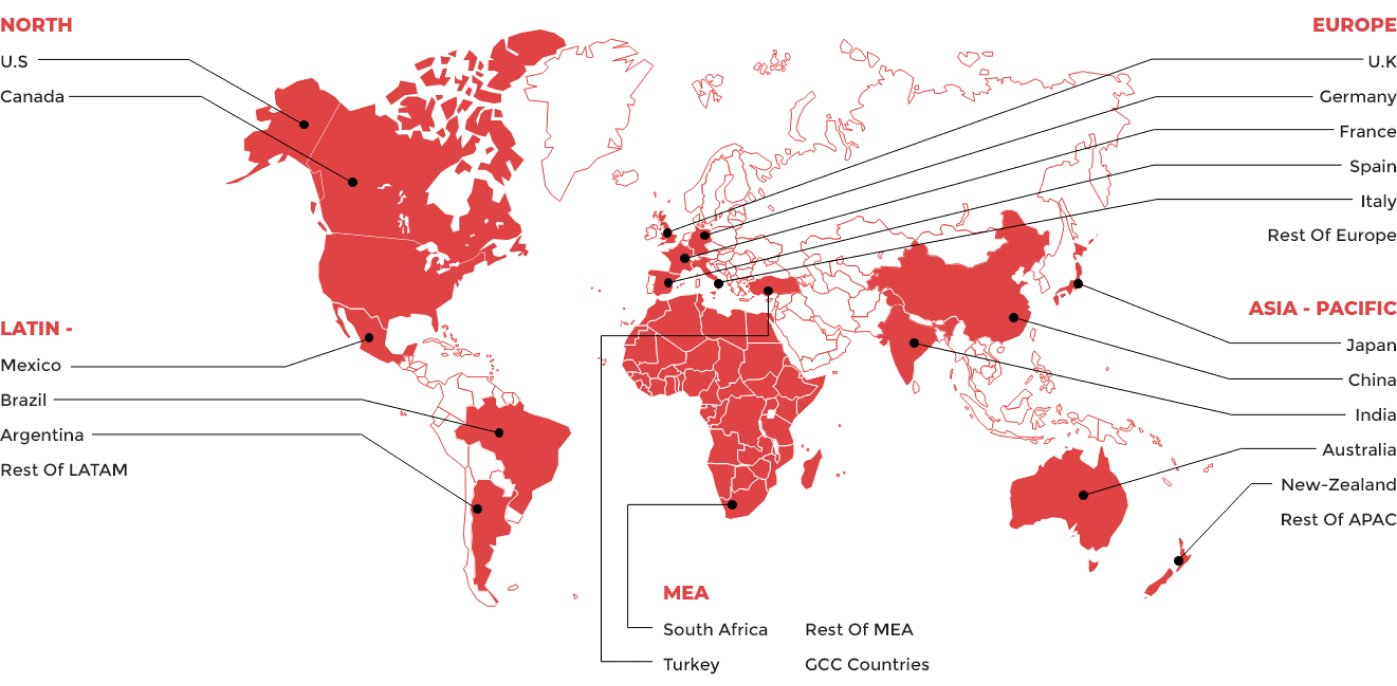

The market has been classified into North America, Asia Pacific, Europe, Latin America, Middle East and Africa, and the rest of MEA.

Content Updated Date: Feb 2026

| 1. Executive Summary |

| 2. Global Immunological Rare Disease Market Introduction |

| 2.1.Global Immunological Rare Disease Market - Taxonomy |

| 2.2.Global Immunological Rare Disease Market - Definitions |

| 2.2.1.Drug Class |

| 2.2.2.Disease Indication |

| 2.2.3.Distribution Channel |

| 2.2.4.Geography |

| 2.2.5.Region |

| 3. Global Immunological Rare Disease Market Dynamics |

| 3.1. Drivers |

| 3.2. Restraints |

| 3.3. Opportunities/Unmet Needs of the Market |

| 3.4. Trends |

| 3.5. Product Landscape |

| 3.6. New Product Launches |

| 3.7. Impact of COVID 19 on Market |

| 4. Global Immunological Rare Disease Market Analysis, 2020 - 2024 and Forecast 2025 - 2031 |

| 4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) |

| 4.3. Market Opportunity Analysis |

| 5. Global Immunological Rare Disease Market By Drug Class, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 5.1. Monoclonal Antibody |

| 5.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.1.3. Market Opportunity Analysis |

| 5.2. Immunosuppressants |

| 5.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.2.3. Market Opportunity Analysis |

| 5.3. Fusion Proteins |

| 5.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.3.3. Market Opportunity Analysis |

| 5.4. Others |

| 5.4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.4.3. Market Opportunity Analysis |

| 6. Global Immunological Rare Disease Market By Disease Indication, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 6.1. Rheumatoid Arthritis |

| 6.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.1.3. Market Opportunity Analysis |

| 6.2. Psoriatic Arthritis |

| 6.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.2.3. Market Opportunity Analysis |

| 6.3. Plaque Psoriasis |

| 6.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.3.3. Market Opportunity Analysis |

| 6.4. Ankylosing Spondylitis |

| 6.4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.4.3. Market Opportunity Analysis |

| 6.5. Inflammatory Bowel Disease |

| 6.5.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.5.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.5.3. Market Opportunity Analysis |

| 6.6. Prophylaxis of Organ Rejection |

| 6.6.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.6.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.6.3. Market Opportunity Analysis |

| 6.7. Others |

| 6.7.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.7.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.7.3. Market Opportunity Analysis |

| 7. Global Immunological Rare Disease Market By Distribution Channel, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 7.1. Hospital Pharmacies |

| 7.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.1.3. Market Opportunity Analysis |

| 7.2. Retail Pharmacies |

| 7.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.2.3. Market Opportunity Analysis |

| 7.3. Online Pharmacies |

| 7.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.3.3. Market Opportunity Analysis |

| 8. Global Immunological Rare Disease Market By Geography, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 8.1. North America |

| 8.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 8.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 8.1.3. Market Opportunity Analysis |

| 8.2. Europe |

| 8.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 8.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 8.2.3. Market Opportunity Analysis |

| 8.3. The Asia Pacific |

| 8.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 8.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 8.3.3. Market Opportunity Analysis |

| 8.4. Latin America |

| 8.4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 8.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 8.4.3. Market Opportunity Analysis |

| 8.5. MEA |

| 8.5.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 8.5.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 8.5.3. Market Opportunity Analysis |

| 9. Global Immunological Rare Disease Market By Region, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 9.1. North America |

| 9.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 9.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 9.1.3. Market Opportunity Analysis |

| 9.2. Europe |

| 9.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 9.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 9.2.3. Market Opportunity Analysis |

| 9.3. Asia Pacific (APAC) |

| 9.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 9.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 9.3.3. Market Opportunity Analysis |

| 9.4. Middle East and Africa (MEA) |

| 9.4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 9.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 9.4.3. Market Opportunity Analysis |

| 9.5. Latin America |

| 9.5.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 9.5.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 9.5.3. Market Opportunity Analysis |

| 10. North America Immunological Rare Disease Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 10.1. Drug Class Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.1.1.Monoclonal Antibody |

| 10.1.2.Immunosuppressants |

| 10.1.3.Fusion Proteins |

| 10.1.4.Others |

| 10.2. Disease Indication Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.2.1.Rheumatoid Arthritis |

| 10.2.2.Psoriatic Arthritis |

| 10.2.3.Plaque Psoriasis |

| 10.2.4.Ankylosing Spondylitis |

| 10.2.5.Inflammatory Bowel Disease |

| 10.2.6.Prophylaxis of Organ Rejection |

| 10.2.7.Others |

| 10.3. Distribution Channel Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.3.1.Hospital Pharmacies |

| 10.3.2.Retail Pharmacies |

| 10.3.3.Online Pharmacies |

| 10.4. Geography Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.4.1.North America |

| 10.4.2.Europe |

| 10.4.3.The Asia Pacific |

| 10.4.4.Latin America |

| 10.4.5.MEA |

| 10.5. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.5.1.United States of America (USA) |

| 10.5.2.Canada |

| 11. Europe Immunological Rare Disease Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 11.1. Drug Class Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.1.1.Monoclonal Antibody |

| 11.1.2.Immunosuppressants |

| 11.1.3.Fusion Proteins |

| 11.1.4.Others |

| 11.2. Disease Indication Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.2.1.Rheumatoid Arthritis |

| 11.2.2.Psoriatic Arthritis |

| 11.2.3.Plaque Psoriasis |

| 11.2.4.Ankylosing Spondylitis |

| 11.2.5.Inflammatory Bowel Disease |

| 11.2.6.Prophylaxis of Organ Rejection |

| 11.2.7.Others |

| 11.3. Distribution Channel Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.3.1.Hospital Pharmacies |

| 11.3.2.Retail Pharmacies |

| 11.3.3.Online Pharmacies |

| 11.4. Geography Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.4.1.North America |

| 11.4.2.Europe |

| 11.4.3.The Asia Pacific |

| 11.4.4.Latin America |

| 11.4.5.MEA |

| 11.5. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.5.1.Germany |

| 11.5.2.France |

| 11.5.3.Italy |

| 11.5.4.United Kingdom (UK) |

| 11.5.5.Spain |

| 11.5.6.Rest of EU |

| 12. Asia Pacific (APAC) Immunological Rare Disease Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 12.1. Drug Class Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.1.1.Monoclonal Antibody |

| 12.1.2.Immunosuppressants |

| 12.1.3.Fusion Proteins |

| 12.1.4.Others |

| 12.2. Disease Indication Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.2.1.Rheumatoid Arthritis |

| 12.2.2.Psoriatic Arthritis |

| 12.2.3.Plaque Psoriasis |

| 12.2.4.Ankylosing Spondylitis |

| 12.2.5.Inflammatory Bowel Disease |

| 12.2.6.Prophylaxis of Organ Rejection |

| 12.2.7.Others |

| 12.3. Distribution Channel Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.3.1.Hospital Pharmacies |

| 12.3.2.Retail Pharmacies |

| 12.3.3.Online Pharmacies |

| 12.4. Geography Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.4.1.North America |

| 12.4.2.Europe |

| 12.4.3.The Asia Pacific |

| 12.4.4.Latin America |

| 12.4.5.MEA |

| 12.5. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.5.1.China |

| 12.5.2.India |

| 12.5.3.Australia and New Zealand (ANZ) |

| 12.5.4.Japan |

| 12.5.5.Rest of APAC |

| 13. Middle East and Africa (MEA) Immunological Rare Disease Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 13.1. Drug Class Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 13.1.1.Monoclonal Antibody |

| 13.1.2.Immunosuppressants |

| 13.1.3.Fusion Proteins |

| 13.1.4.Others |

| 13.2. Disease Indication Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 13.2.1.Rheumatoid Arthritis |

| 13.2.2.Psoriatic Arthritis |

| 13.2.3.Plaque Psoriasis |

| 13.2.4.Ankylosing Spondylitis |

| 13.2.5.Inflammatory Bowel Disease |

| 13.2.6.Prophylaxis of Organ Rejection |

| 13.2.7.Others |

| 13.3. Distribution Channel Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 13.3.1.Hospital Pharmacies |

| 13.3.2.Retail Pharmacies |

| 13.3.3.Online Pharmacies |

| 13.4. Geography Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 13.4.1.North America |

| 13.4.2.Europe |

| 13.4.3.The Asia Pacific |

| 13.4.4.Latin America |

| 13.4.5.MEA |

| 13.5. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 13.5.1.GCC Countries |

| 13.5.2.South Africa |

| 13.5.3.Rest of MEA |

| 14. Latin America Immunological Rare Disease Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 14.1. Drug Class Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 14.1.1.Monoclonal Antibody |

| 14.1.2.Immunosuppressants |

| 14.1.3.Fusion Proteins |

| 14.1.4.Others |

| 14.2. Disease Indication Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 14.2.1.Rheumatoid Arthritis |

| 14.2.2.Psoriatic Arthritis |

| 14.2.3.Plaque Psoriasis |

| 14.2.4.Ankylosing Spondylitis |

| 14.2.5.Inflammatory Bowel Disease |

| 14.2.6.Prophylaxis of Organ Rejection |

| 14.2.7.Others |

| 14.3. Distribution Channel Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 14.3.1.Hospital Pharmacies |

| 14.3.2.Retail Pharmacies |

| 14.3.3.Online Pharmacies |

| 14.4. Geography Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 14.4.1.North America |

| 14.4.2.Europe |

| 14.4.3.The Asia Pacific |

| 14.4.4.Latin America |

| 14.4.5.MEA |

| 14.5. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 14.5.1.Brazil |

| 14.5.2.Mexico |

| 14.5.3.Rest of LA |

| 15. Competition Landscape |

| 15.1. Market Player Profiles (Introduction, Brand/Product Sales, Financial Analysis, Product Offerings, Key Developments, Collaborations, M & A, Strategies, and SWOT Analysis) |

| 15.2.1.AbbVie, Inc. (U.S.) |

| 15.2.2.Janssen Global Services, LLC (U.S.) |

| 15.2.3. Eli Lilly and Company (U.S.) |

| 15.2.4.Novartis AG (Switzerland) |

| 15.2.5.Pfizer Inc. (U.S.) |

| 15.2.6.Bristol-Myers Squibb Company (U.S.) |

| 15.2.7.Merck Sharp & Dohme Corp. (U.S.) |

| 15.2.8.F. Hoffmann-La Roche Ltd. (Switzerland) |

| 15.2.9.Amgen Inc. (U.S.) |

| 15.2.10.Astellas Pharma Inc. (Japan) |

| 15.2.11.UCB SA (Belgium) |

| 16. Research Methodology |

| 17. Appendix and Abbreviations |

Key Market Players