Author

Manoj Kumar is a postgraduate in Life Sciences with over seven years of dedicated experience in the fields of anima.....

Agriculture Reinsurance Market: By Product Coverage, By Distribution Channel and Region Forecast 2021-2032.

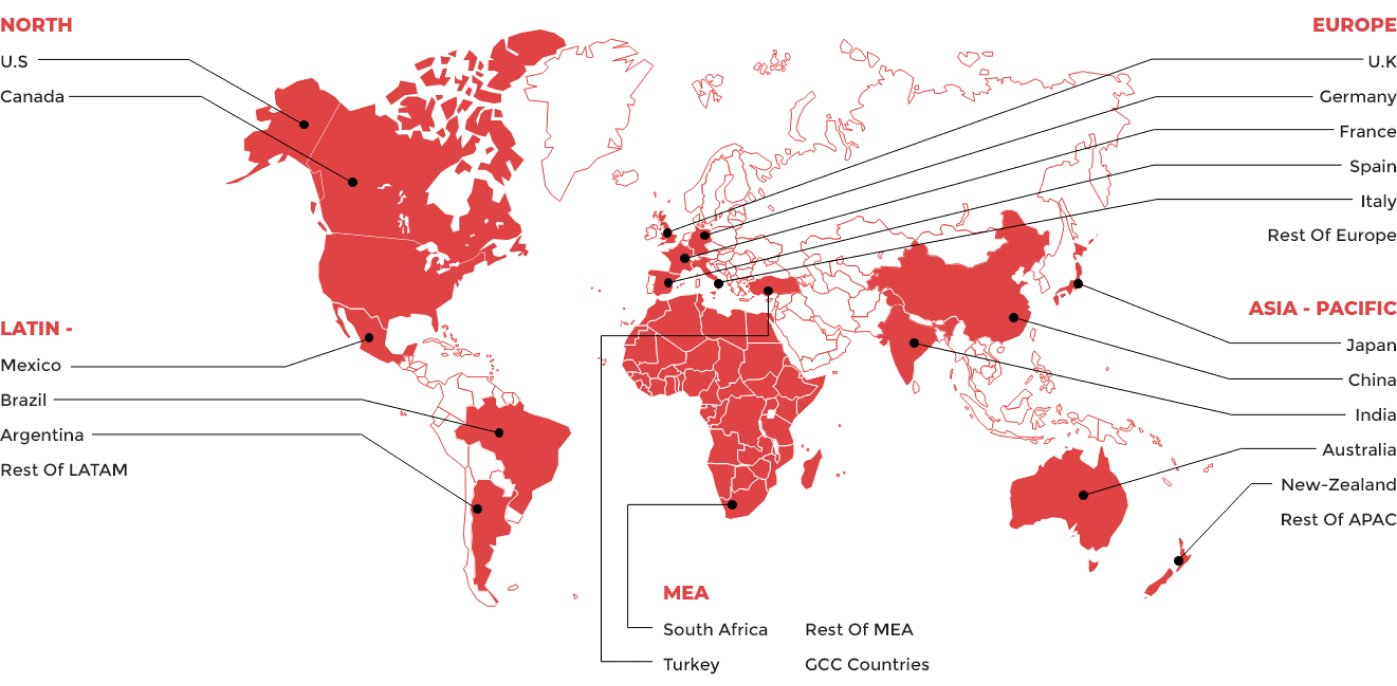

Agriculture Reinsurance Market size was valued at US$ 19,825.0 million in 2025 and is expected to reach US$ 47,514.1 million by 2032, growing at a significant CAGR of 13.3% from 2026-2032. Agriculture Insurance is the production and financial risks of farmer associated with the shortfall risks of stakeholders such as input suppliers and grain processors. The term ceding can be defined as the insurance of insurance. In reinsurance the insurer bares risk and premium. Governments engagement in subsidized reinsurance and wide participation of private reinsurance industry are the key growing factors of market. The government’s support for agriculture, technology advancement, and technology revolution are the key growth factors of the market. The loss occurring in the Agro industry can be predicted by using satellite images in real-time.

In addition, the technology also contributes to mitigating the information between the insured and reinsurer, this is expected to boost the growth of the market. The increasing need for having an alternative capital in order to level up the massive demand drives market growth in some countries. Government support also fuels the market growth. For instance, the Indian government has committed itself in funding the reinsurance scheme due to profitable social and economic benefits strong crop insurance market. Asia Pacific region is the prominent region to show significant growth in the market due to its natural diversification owing to large number of Agro-climatic zones. Hence, geographically Asia Pacific region is expected to hold the major market share and is expected to dominate the global market in the forecasted years.

Study Period

2026-2032Base Year

2025CAGR

13.3%Largest Market

Asia-PacificFastest Growing Market

North-America

Agriculture reinsurance market is growing due to the increasing risks of losing crop in agriculture due to natural disasters, insufficient water supply, climatic factors and other factors. In addition, the Governments engagement in subsidized reinsurance and wide participation of private reinsurance industry is expected to boost the growth of market. The technology advancement, rising investments on research and development by the key players also play an important role in the growth of market. Regions like Asia pacific is expected to have an significant growth in the forecasted period due to its natural diversification owing to increased number of Agro-climatic zones. Hence, this will drive the global market growth at a significant rate.

|

Report Benchmarks |

Details |

|

Report Study Period |

2026-2032 |

|

Market CAGR |

13.3% |

|

By Product |

|

|

By Distribution Channel |

|

|

By Region |

|

Download Free Sample Report

The agriculture reinsurance market size was valued at US$ 15,443.8 million in 2023 and is expected to grow at a CAGR of 13.3% from 2024 to 2030.

Asia Pacific region is expected to have an significant growth in the forecasted years followed by Latin America and Africa.

The leading players in the global Agriculture Reinsurance market are Swiss Reinsurance Company Ltd., Sompo International Holdings Ltd., Axa XL, Syngenta, Munich Re, Agroinsurance, Hanover Re, Partner Re, Scor Re, Gramcover, Mapfre Re, Berkshire Hathaway, Everest Re, China Reinsurance, QBE, Tokio Marine

Historic years considered for the market study are 2018 through 2022, 2022 is considered as the base year for market estimation and Seven years forecast presented from 2023– 2029.

Content Updated Date: Feb 2026

| 1. Executive Summary |

| 2. Global Agriculture Reinsurance Market Introduction |

| 2.1.Global Agriculture Reinsurance Market - Taxonomy |

| 2.2.Global Agriculture Reinsurance Market - Definitions |

| 2.2.1.Product |

| 2.2.2.Distribution Channel |

| 2.2.3.Region |

| 3. Global Agriculture Reinsurance Market Dynamics |

| 3.1. Drivers |

| 3.2. Restraints |

| 3.3. Opportunities/Unmet Needs of the Market |

| 3.4. Trends |

| 3.5. Product Landscape |

| 3.6. New Product Launches |

| 3.7. Impact of COVID-19 on Market |

| 4. Global Agriculture Reinsurance Market Analysis, 2020 - 2024 and Forecast 2025 - 2031 |

| 4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) |

| 4.3. Market Opportunity Analysis |

| 5. Global Agriculture Reinsurance Market By Product, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 5.1. Multi-peril Crop Insurance |

| 5.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.1.3. Market Opportunity Analysis |

| 5.2. Crop-hail Insurance |

| 5.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.2.3. Market Opportunity Analysis |

| 5.3. Livestock Insurance |

| 5.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.3.3. Market Opportunity Analysis |

| 5.4. Greenhouse Insurance |

| 5.4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.4.3. Market Opportunity Analysis |

| 5.5. Others |

| 5.5.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 5.5.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 5.5.3. Market Opportunity Analysis |

| 6. Global Agriculture Reinsurance Market By Distribution Channel, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 6.1. Banks |

| 6.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.1.3. Market Opportunity Analysis |

| 6.2. Insurance Companies |

| 6.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.2.3. Market Opportunity Analysis |

| 6.3. Brokers/Agents |

| 6.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.3.3. Market Opportunity Analysis |

| 6.4. Others |

| 6.4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 6.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 6.4.3. Market Opportunity Analysis |

| 7. Global Agriculture Reinsurance Market By Region, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 7.1. North America |

| 7.1.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.1.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.1.3. Market Opportunity Analysis |

| 7.2. Europe |

| 7.2.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.2.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.2.3. Market Opportunity Analysis |

| 7.3. Asia Pacific (APAC) |

| 7.3.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.3.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.3.3. Market Opportunity Analysis |

| 7.4. Middle East and Africa (MEA) |

| 7.4.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.4.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.4.3. Market Opportunity Analysis |

| 7.5. Latin America |

| 7.5.1. Market Analysis, 2020 - 2024 and Forecast, 2025 - 2031, (Sales Value USD Million) |

| 7.5.2. Year-Over-Year (Y-o-Y) Growth Analysis (%) and Market Share Analysis (%) |

| 7.5.3. Market Opportunity Analysis |

| 8. North America Agriculture Reinsurance Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 8.1. Product Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 8.1.1.Multi-peril Crop Insurance |

| 8.1.2.Crop-hail Insurance |

| 8.1.3.Livestock Insurance |

| 8.1.4.Greenhouse Insurance |

| 8.1.5.Others |

| 8.2. Distribution Channel Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 8.2.1.Banks |

| 8.2.2.Insurance Companies |

| 8.2.3.Brokers/Agents |

| 8.2.4.Others |

| 8.3. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 8.3.1.United States of America (USA) |

| 8.3.2.Canada |

| 9. Europe Agriculture Reinsurance Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 9.1. Product Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 9.1.1.Multi-peril Crop Insurance |

| 9.1.2.Crop-hail Insurance |

| 9.1.3.Livestock Insurance |

| 9.1.4.Greenhouse Insurance |

| 9.1.5.Others |

| 9.2. Distribution Channel Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 9.2.1.Banks |

| 9.2.2.Insurance Companies |

| 9.2.3.Brokers/Agents |

| 9.2.4.Others |

| 9.3. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 9.3.1.Germany |

| 9.3.2.France |

| 9.3.3.Italy |

| 9.3.4.United Kingdom (UK) |

| 9.3.5.Spain |

| 9.3.6.Rest of EU |

| 10. Asia Pacific (APAC) Agriculture Reinsurance Market ,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 10.1. Product Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.1.1.Multi-peril Crop Insurance |

| 10.1.2.Crop-hail Insurance |

| 10.1.3.Livestock Insurance |

| 10.1.4.Greenhouse Insurance |

| 10.1.5.Others |

| 10.2. Distribution Channel Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.2.1.Banks |

| 10.2.2.Insurance Companies |

| 10.2.3.Brokers/Agents |

| 10.2.4.Others |

| 10.3. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 10.3.1.China |

| 10.3.2.India |

| 10.3.3.Australia and New Zealand (ANZ) |

| 10.3.4.Japan |

| 10.3.5.Rest of APAC |

| 11. Middle East and Africa (MEA) Agriculture Reinsurance Market,2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 11.1. Product Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.1.1.Multi-peril Crop Insurance |

| 11.1.2.Crop-hail Insurance |

| 11.1.3.Livestock Insurance |

| 11.1.4.Greenhouse Insurance |

| 11.1.5.Others |

| 11.2. Distribution Channel Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.2.1.Banks |

| 11.2.2.Insurance Companies |

| 11.2.3.Brokers/Agents |

| 11.2.4.Others |

| 11.3. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 11.3.1.GCC Countries |

| 11.3.2.South Africa |

| 11.3.3.Rest of MEA |

| 12. Latin America Agriculture Reinsurance Market, 2020 - 2024 and Forecast 2025 - 2031 (Sales Value USD Million) |

| 12.1. Product Analysis and Forecast by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.1.1.Multi-peril Crop Insurance |

| 12.1.2.Crop-hail Insurance |

| 12.1.3.Livestock Insurance |

| 12.1.4.Greenhouse Insurance |

| 12.1.5.Others |

| 12.2. Distribution Channel Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.2.1.Banks |

| 12.2.2.Insurance Companies |

| 12.2.3.Brokers/Agents |

| 12.2.4.Others |

| 12.3. Country Analysis 2020 - 2024 and Forecast 2025 - 2031 by Sales Value USD Million, Y-o-Y Growth (%), and Market Share (%) |

| 12.3.1.Brazil |

| 12.3.2.Mexico |

| 12.3.3.Rest of LA |

| 13. Competition Landscape |

| 13.1. Market Player Profiles (Introduction, Brand/Product Sales, Financial Analysis, Product Offerings, Key Developments, Collaborations, M & A, Strategies, and SWOT Analysis) |

| 13.2.1.Swiss Reinsurance Company Ltd |

| 13.2.2.Sompo International Holdings Ltd |

| 13.2.3.Axa XL |

| 13.2.4.Syngenta |

| 13.2.5.Munich Re |

| 13.2.6.Agroinsurance |

| 13.2.7.Hanover Re |

| 13.2.8.Partner Re |

| 13.2.9.Scor Re |

| 13.2.10.Gramcover |

| 13.2.11.Mapfre Re |

| 13.2.12.Berkshire Hathaway |

| 13.2.13.Everest Re |

| 13.2.14.China Reinsurance |

| 13.2.15.QBE |

| 13.2.16.Tokio Marine |

| 14. Research Methodology |

| 15. Appendix and Abbreviations |

Key Market Players